Private student loans for bad credit and no cosigner

Credible evaluated private student loan lenders in 10 different categories to determine the best lenders for graduate student loans. Cierra Murry is an expert in banking credit cards investing loans mortgages and real estate.

Top Student Loans Without A Cosigner Of September 2022

The company can help you find both short-term cash loans and longer-term personal loans.

. MoneyMutual is our perennially top-ranked company for cash loans it arranges between you and the lenders on its network. Student or cosigner must meet the age of majority in their state of residence. Credible evaluated private student loan lenders in 10 different categories to determine the best lenders for graduate student loans.

You might also be able to get approved by applying. To get a student loan with bad credit choose federal student loans first. Lowest APRs are available to the most creditworthy applicants and include an interest-only repayment discount and Auto Debit Reward.

With this choice you can obtain a cash payday loan that you quickly repay or a bad credit personal loan with a repayment term ranging from three to 72. Minimum credit score. This mainly depends on what type of student loans you have.

Can I get a private student loan with bad credit or no credit. Learn more about student loans. If you have private student loans refinancing might get you a lower interest rate or reduced monthly payment or both which could help you more easily manage your loans during the COVID-19 pandemicYou can check rates and potentially prequalify for a much lower rate than what you have right now.

APR ranges will vary by loan type and may be higher than what is shown here. My name is Kaleigh Kelso and I am a high school senior. Direct PLUS Loans can be taken out by parents of students Parent PLUS or graduate students to help pay for educational expenses.

670 Maximum loan amount. Refinance Medical School Loans. If you have bad credit.

I have a strong passion for kids. On the other. Students with no credit score or eligible students that meet a minimum credit score but dont have two years of credit history can apply for certain non-cosigned loans as well.

Refinance Federal Student Loans. You can get a student loan with bad credit but not necessarily on your own. Student loans without a cosigner.

2001 to 200000 Loan terms years. This mainly depends on what type of student loans you have. Its aimed at borrowers without any credit history or who dont meet.

Student loans without a cosigner. Sallie Mae loans are subject to credit approval identity verification signed loan documents and school certification. Applying with a creditworthy cosigner may improve your likelihood for loan approval and you may receive a.

Best for fixed-rate loans. APRs shown are for undergraduate loans. With Ascent there are no origination application disbursement or prepayment penalties tied to undergraduate or graduate private student loans.

Bad Credit Student Loans. The Future Income-Based Loan is one of two student loans Ascent offers to undergraduates that dont require a co-signer. These loans do set rates based on credit score and income so.

Ascent offers cosigned credit-based non-cosigned credit-based non-cosigned-outcomes-based juniors and seniors MBA dental medical and PhD private student loans. For private loans youll need a niche lender that doesnt consider credit. However adverse credit history like.

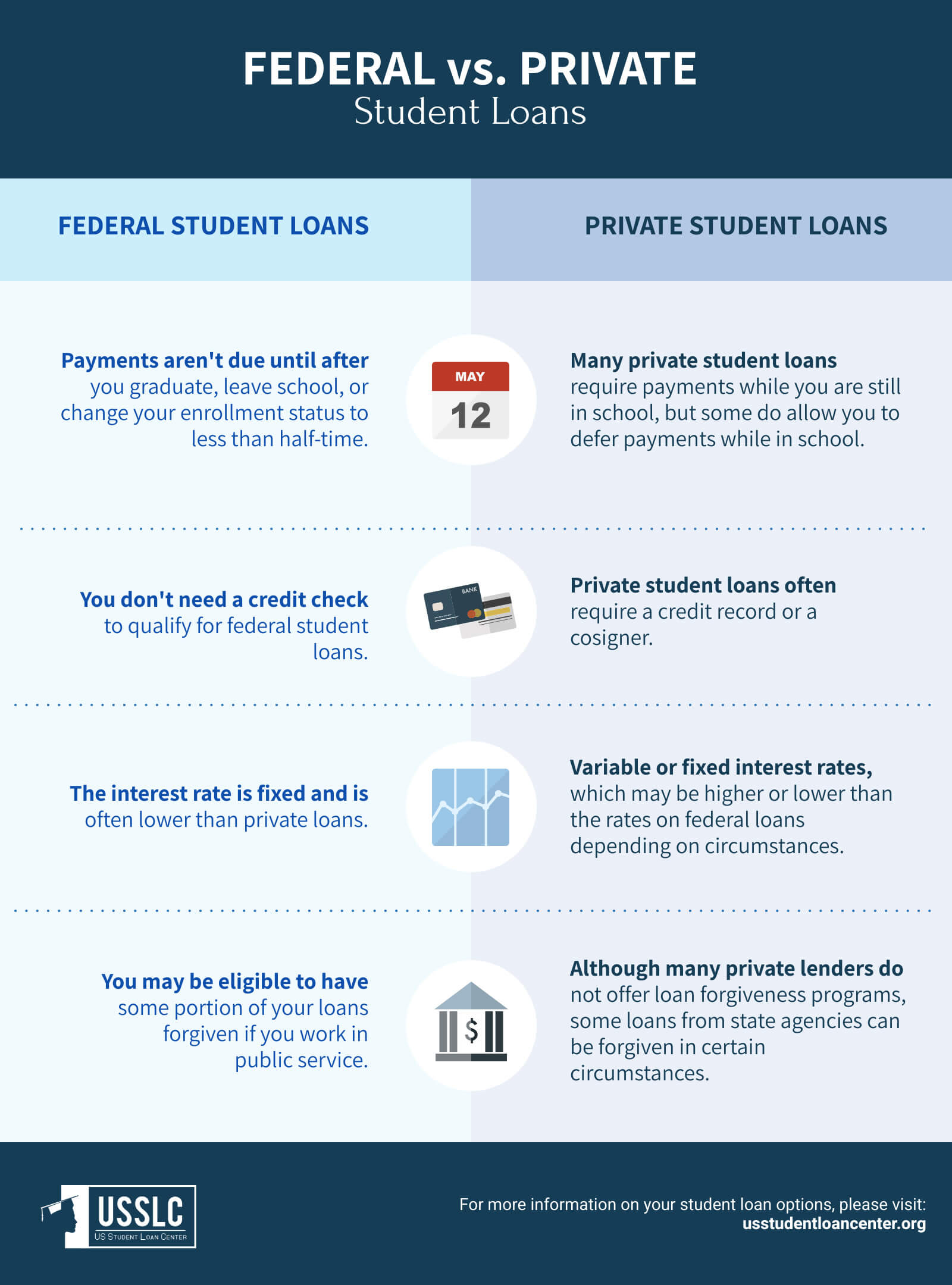

After exploring federal student loan options undergraduate students have the option to pursue private student loans as well. These loans do require a credit check and they have higher interest rates than other federal loans. This loan is available to students at participating schools and is not intended for students pursuing a graduate degree.

Direct PLUS Loans. Learn more about student loans. Eligibility requirements for a parent PLUS loan are less stringent than those of private student loans so parents with bad credit can still get approved.

Best Student Loan Refinance Companies. Another big difference between repaying federal student loans and repaying private student loans is that borrowers do not have to begin repaying their federal student loans until six months after graduation. Lenders that allowed cosigners to be released from the loan were valued.

Many lenders require incomes of 30000 and up. Up to 100 of the school-certified cost of attendance minus any other aid MEFA. However these loans come with significantly higher interest rates than traditional private student loans.

If you have private student loans refinancing might get you a lower interest rate or reduced monthly payment or both which could help you more easily manage your loans during the COVID-19 pandemicYou can check rates and potentially prequalify for a much lower rate than what you have right now. Be hard to qualify for a personal loan if you have a score in this range unless you work with a lender that offers bad credit loans. Best for No-Cosigner Loans AM.

She is a banking consultant loan signing agent and arbitrator with more than 15 years of experience in financial analysis underwriting loan documentation loan review banking compliance and credit risk management. Its aimed at borrowers without any credit history or who dont meet. This grace period is designed to give borrowers time to find work and build wealth before they begin making loan payments.

Refinance Parent PLUS Loans. 20 Comments on Bad Credit Student Loans With No Cosigner Kaleigh Kelso wrote. This included interest rates repayment options terms fees.

Most estimates have over 90 of new private student loans including a cosigner. The Future Income-Based Loan is one of two student loans Ascent offers to undergraduates that dont require a co-signer. 1 cash back graduation reward Cosigner release.

PLUS Loans are more similar to private loans than other types of federal loans. A fixed APR of 489 and up is available. See current rates on federal and private student loans plus our picks for the best private student loans for parents independent students and graduate school.

I am very excited to graduate this May and going to college in the state of Missouri to study childrens psychology and elementary education. Best private student loans. 5 7 10 12 15 20 depending on loan type Discounts.

025 to 1 automatic payment discount. Personal loans for all your financial needs - get prequalified in just 3 minutes. This included interest rates repayment options terms fees.

24000 is the minimum salary requirement to qualify for a non-cosigned loan. While federal loans don.

How To Get A Student Loan Without A Cosigner Student Loan Hero

How To Get Student Loans Without A Cosigner No Cosigner No Problem

:max_bytes(150000):strip_icc()/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg)

Private Vs Federal College Loans What S The Difference

Best Student Loans For Applying Without A Cosigner Credible

Student Loan Forgiveness Company Letterhead Letter Sample

Best Private Best Private Student Loans Without Cosigner Leverage Edu

Top Student Loans Without A Cosigner Of September 2022

Top Student Loans Without A Cosigner Of September 2022

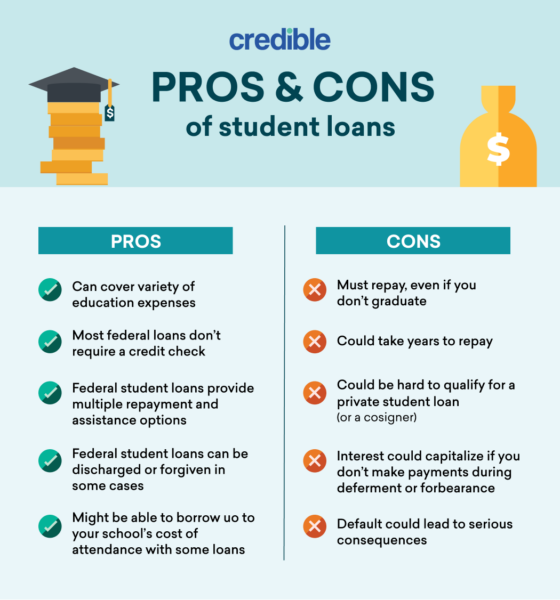

The Pros And Cons Of Student Loans Are They Worth It Credible

What To Do If You Re Denied A Student Loan With A Cosigner Credible

How To Get A Student Loan Without A Cosigner Student Loan Hero

3 Best Private Student Loans That Don T Require A Cosigner Credible

3 Best Private Student Loans That Don T Require A Cosigner Credible

Private Student Loans Without Cosigner Us Student Loan Center

Top Student Loans Without A Cosigner Of September 2022

6 International Student Loans That Don T Require A Cosigner 2022

Top Student Loans Without A Cosigner Of September 2022