24+ Mortgage borrowing ratio

Call 0808 189 2301 or make an enquiry onlin e and well match you with a mortgage broker who specialises in borrowed deposit mortgages today. ASCII characters only characters found on a standard US keyboard.

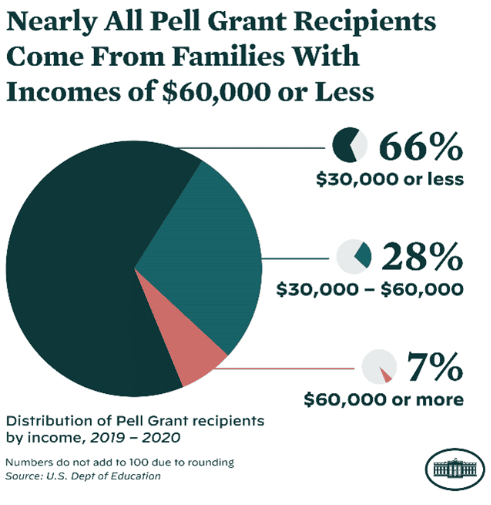

Debt To Income Ratio Advance America

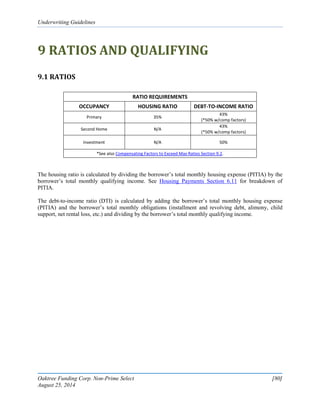

High loan-to-value ratioseven up to 100are allowed for certain residential mortgages such as USDA or VA loans.

. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. A Definitions--In this section-- 1 the term covered loan means a loan guaranteed under paragraph 36 of section 7a of the Small Business Act 15 USC. 1091 The best writer.

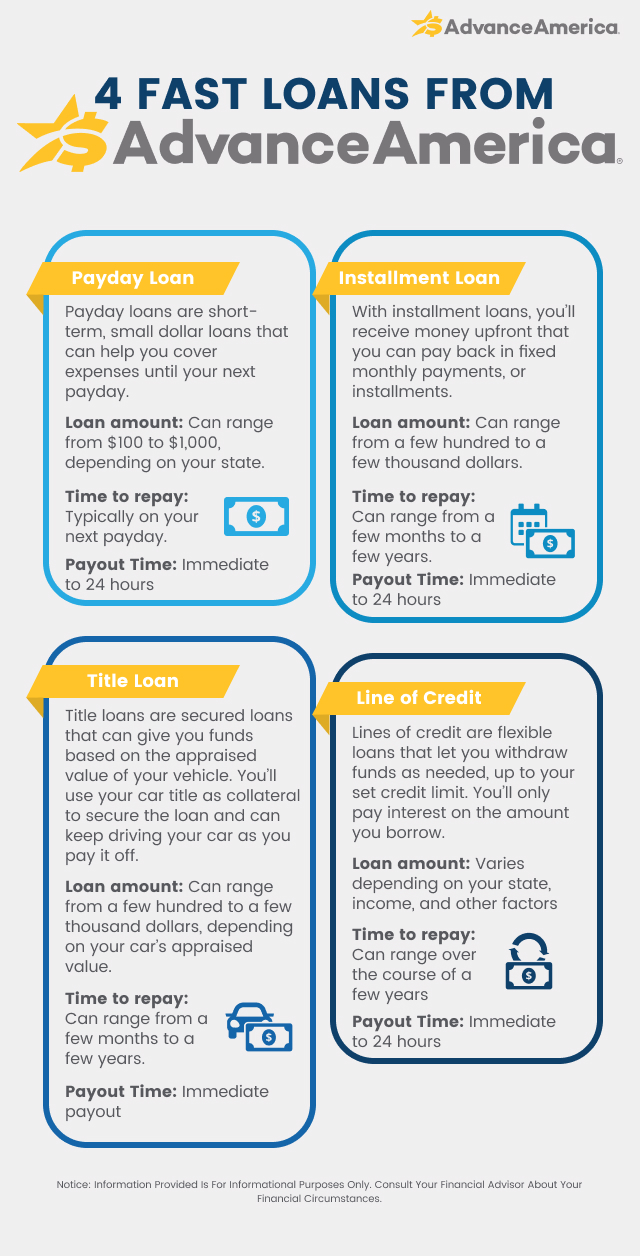

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. New home loan applications Mon - Fri 8 am. The Ins and Outs of Loans Mortgages and Credit Lines.

636a as added by section 1102. Our industry-leading education centres and calculators are available 247 free of charge and. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

A high-ratio mortgage is a mortgage loan higher than 80 of the propertys value. APR stands for annual percentage rate and its the price you pay for borrowing a sum of money from a bank or lenderThe percentage represents the yearly cost of the loan. Freddie Mac and the National Association of Homebuilders expect mortgage rates to be 3 in 2021 while the National Association of Realtors thinks it will reach 32 and Wells Fargo thinks rates will be 289.

These are also only available to older homeowners 62 or older for Home Equity Conversion Mortgage the most popular reverse mortgage product or 55 and older for some proprietary reverse mortgages. Use Ratehubcas Mortgage Affordability Calculator to help figure out the maximum purchase price that you can qualify for. Must contain at least 4 different symbols.

The most popular residential mortgage product is the 30-year fixed-rate mortgage. A deficit occurs when a governments expenditures exceed revenues. Median multiples Commercial building consent analysis Residential building consent analysis Rental yield indicator Rent ratio Commercial property for.

Most lenders require a combined loan-to-value ratio CLTV of 85 percent or less a credit score of 620 or higher and a debt-to-income DTI ratio below 43 percent to approve you for a home equity. 2 the term covered mortgage obligation means any indebtedness or debt instrument incurred in the ordinary course of business that-- A is a. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

Well always be happy to help you out. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022. Second mortgage types Lump sum.

By speaking to a broker with this expertise you will be fully prepared for any problems you might face when borrowing a deposit and boost your chances of mortgage approval. Maximum loan to value ratio 6000 minimum borrowing amount 80000 maximum borrowing amount 5000000 type of mortgage Variable Repayment types Principal Interest Availability Owner Occupier Repayment options. Over time this could increase supply as demand decreases and the housing boom and high.

You can contact us any time of day and night with any questions. Reached about 6 per cent per annum. 7982 Government debt may be owed to domestic residents as well as to.

A countrys gross government debt also called public debt or sovereign debt is the financial liabilities of the government sector. You can contact us any time of day and night with any questions. You can consolidate all your credit card payments down to one monthly affordable fixed-rate payment between 599 and 2499 APR This does not constitute an actual commitment to lend or an.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Variable comparison rate 446 pa. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee.

Any mortgage with less than a 20 down payment is known as a high-ratio mortgage and requires you to purchase mortgage. 81 Changes in government debt over time reflect primarily borrowing due to past government deficits. Well always be happy to help you out.

Check out the latest breaking news videos and viral videos covering showbiz sport fashion technology and more from the Daily Mail and Mail on Sunday. Before sharing sensitive information make sure youre on a federal government site. 18 months 519 effective on.

The gov means its official. Down payment of at least 3 with potential to save on private mortgage insurance. However gross borrowing costs are substantially higher than the nominal interest rate and amounted for the last 30 years to 1046 per cent.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Open 247 Home Loans. When you see a great APR advertised its usually the lowest rate available.

Debt-to-income ratio of up to 50 depending on the transaction. The loan to value ratio or LTV is the size of the loan against the value of the property. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

1091 The best writer. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Federal government websites often end in gov or mil. To access the optimum mortgage to salary ratio its therefore important to find a lender that accepts the right type of supplementary income and is willing to utilise as much of it as possible. Variable for 24 months and then 450 pa.

In Denmark similar to the United States mortgage market interest rates. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. 6 to 30 characters long.

Youll see the term APR whenever you apply for a credit card mortgage car loan student loan or any other type of loan. A whole-of-market broker will be able to help you access those lenders who can be most flexible with your specific additional income types. As mortgage rates go up the cost of borrowing and purchasing a home becomes more expensive.

15 Debt Payoff Planner Apps Tools Get Out Of Debt Debt To Income Ratio Managing Finances Money Saving Strategies

2

24 Salary To Mortgage Ratio Olufemiorlyn

Sustained Credit Card Borrowing Grodzicki 2021 Journal Of Consumer Affairs Wiley Online Library

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Amortization Calculator

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Is This An Affordable Mortgage For Me Household Expenses Debt To Income Ratio Debt

How To Borrow Money Fast Money Loans Advance America

Non Prime Select Guidelines Call Jesse B Lucero 702 551 3125

How To Get Out Of Debt Pay Off Debt Or Save Advance America

What Happens To The Housing Market When The Stock Market Crashes And Interst Rate Rises Quora

Refinance A Loan Advance America

Installment Loans For Bad Credit Advance America

2

What Is Financial Literacy Advance America

Pros And Cons Of Adjustable Rate Mortgages Adjustable Rate Mortgage First Time Home Buyers First Home Buyer

Holiday And Christmas Loans Advance America